⭐⭐⭐⭐⭐ WineSearcher & Google

Great wine, cellared or delivered

One place for all your wine. Expertly sourced, carefully stored, and delivered when you’re ready.

Trusted by wine lovers, collectors, and investors across Australia 🍷

Wine is more than a drink

Wine is one of life’s great pleasures — and one of the world’s most stable, tangible assets.

TradingGrapes is more than a wine store

We make it easy to bridge the gap between wine as a lifestyle product and an asset, helping you build a collection with purpose — drink now, cellar for later, or collect as an investment.

"Cannot speak highly enough", "Exceptional customer service. Strongly recommended"

Trusted by wine lovers, collectors, and investors across Australia 🍷

⭐⭐⭐⭐⭐ WineSearcher & Google

Want to invest in wine?

Keep scrolling

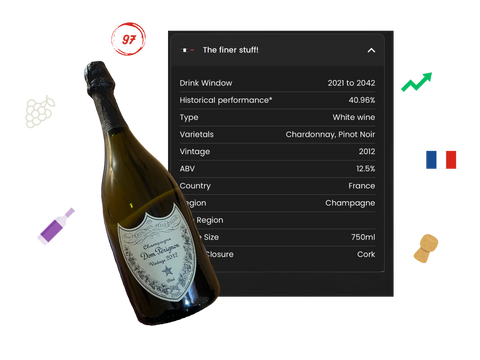

What is investment-grade wine?

Keep scrolling

Drink now

Some wines are meant to be drunk youthful or on release (like a Non Vintage sparkling). Others may be in their drink window (the peak time to enjoy them)

These wines are great for drinking now

Cellar for later

Some wines get better with age. We recommend cellaring them, and we can help with that 😉 - just click cellar my wine on check out

Hint: check the wines drink window - it's flavours will keep evolving as it ages

Investment grade wine

Some wines are an investment that can grow in value. These are the 1%.

In fact, less than 1% of all wine produced globally are investment grade.

These are wines that have built up a track record of high quality, high demand and historically high performance 📈.

They're part of an asset class called collectibles - think fine art, cars, handbags and watches - and over the past decade they've been one of the best performing.

Behind the wine bottle

Stories, insights, and tips for drinking, cellaring & investing in wineFrequently asked questions

Where is my wine cellared?

We store your wine in a state-of-the-art, climate-controlled, secure facility where temperatures are monitored hourly throughout the day to ensure your wine stays in optimal ageing conditions. Our insurance policy covers fire, flood, and theft while your wine is in our care

What makes wine investible?

Most wines are made to drink now—affordable and produced in high volumes. However, wines crafted to age evolve over time, developing deeper flavours and greater complexity. As they mature, their value increases. With less than 1% of wines considered 'investment grade,' each bottle you add to your collection is a rare asset. And once a bottle is gone, it’s gone forever

What is a drink window?

A wine's drink window is the period when it’s said to be at its peak, balancing maturity and freshness. Wines built to age evolve over time, starting with primary flavours (like fruit) and secondary flavours (like oak or spice) that come from the grapes and wine making process at the beginning of the window. As it ages, tertiary flavours (earthy, nutty, or savoury) take over, adding depth and complexity. Knowing a wine's drink window helps collectors decide when to enjoy it, sell it, or hold onto it for a little longer

Do you offer same-day delivery or pick up?

We’re a working cellar and dispatch hub. While we don’t offer same-day delivery or pickups (yet), we’ll always aim to get your wine to you quickly - or you can make an appointment to collect it.

While you're down here, check out the links below and come say hi on our socials 👋